The current state of the market

Australian housing prices have continued to decline with the arrival of spring, posting their biggest monthly fall in nearly 40 years.

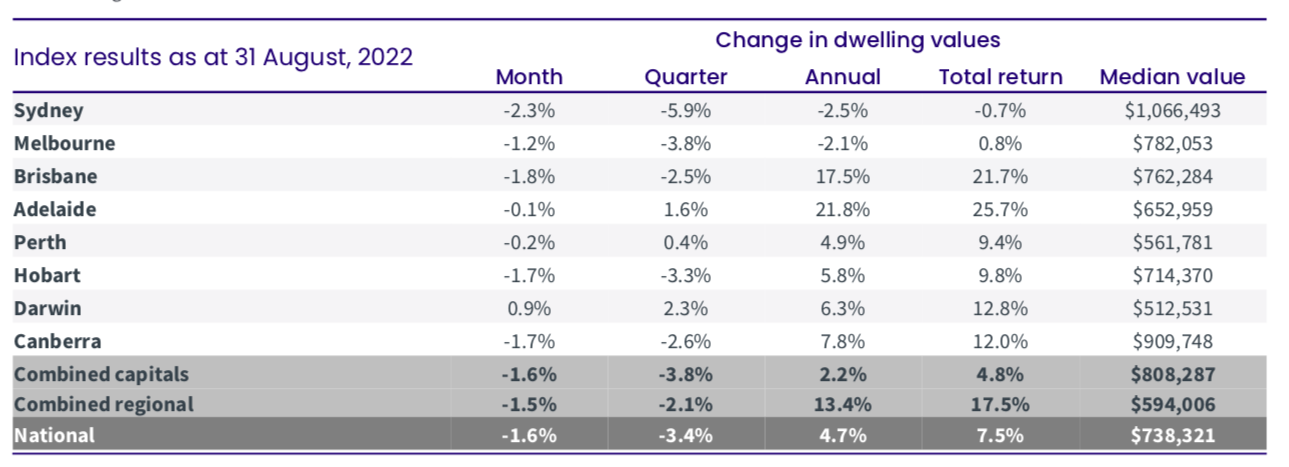

CoreLogic’s home value index tumbled 1.6% month-on-month in August, amidst declines in housing prices for all of Australia’s capital cities with the exception of Darwin.

The CoreLogic Home Value Index for August

Sydney saw the biggest fall, with a drop of 2.3%, followed by Brisbane (-1.8%), Hobart (-1.7%) and Canberra (-1.7%). Melbourne home prices fell another 1.2%, while in Perth they slipped 0.2%, and in Adelaide they edged lower 0.1%.

The nationwide decline in the home value index in August represents the largest monthly fall since 1983, and the fourth consecutive month of decline.

RBA continues to ratchet up rates

The drop in home prices arrives as the Reserve Bank of Australia (RBA) continues to pursue hawkish monetary policy, in a bid to curb unbridled inflation.

On 6 September the RBA announced a rate hike of 0.5 percentage points, bringing the target cash rate to 2.35%. The rate currently stands at its highest level since the start of 2015.

The move by the RBA marks the fifth month in a row that it has raised rates, for a 2.25 percentage point increase since the start of the year.

Rob Flux, developer and educator from the Property Developer Network, said that the RBA’s rate hikes are a key contributor to the nationwide decline in housing prices.

“It’s getting to the point where the RBA’s actions are starting to have an actual impact on prices,” Flux said.

“The market is softening across the board, and this is reflected in the number of properties that are being listed, with fewer people turning up to open homes or searching for properties.”

Flux anticipates at least one to two rate hikes before the end of the year, and expects prices to continue to dwindle well into the first quarter of 2023.

“The biggest buying opportunities for small-scale property developers could lie in February or March of next year, when everyone’s starting to become desperate because prices have dropped but there’s still no one there to buy.”

Full recovery could be still 18 months away

Despite home prices declining at their fastest monthly rate in nearly four decades, a recovery in the medium-term is likely due to the underlying fundamentals of the Australian economy.

Australia is currently suffering from a labour shortage and industrial unrest in the wake of Covid-19 travel restrictions. These issues have prompted the Federal government to raise the skilled migrant cap by 35,000 to 195,000 in total - the first increase in a decade.

The move will lead to a sharp increase in demand for property from an incoming cohort of skilled migrants, which will boost prices given an ongoing shortfall in housing supply.

Daniel He, Property Director, CrowdProperty, said developers should start looking for opportunities now in order to capitalise upon a recovery of the market in the medium-term.

“With permanent immigration increased by 60,000 to 195,000 per annum and construction approvals across the country plummeting, the medium-term fundamentals are looking positive for developers getting into projects today,” He said.

“The ability to negotiate well for buying sites and less competition upon completion of projects could mean that results will outperform in the medium-term.”

Flux expects it to take at least a year for the underlying fundamentals of the market to become apparent, with the RBA’s rate decisions ruling during the interim.

“My prediction is that it will take 12 months before the market re-encounters the true fundamentals, and that we should be in a good place in 18 months if wages rise and inflation is contained” he said.

CrowdProperty provides fast, simple and transparent property project finance for property professionals, learn more.

Contributors

Rob Flux is the owner and founder of Property Developer Network, the largest national network of novice developers and renovators in Australia with a combined community of over 15,000 people.