Marketplace lending — or peer-to-peer (P2P) lending — has emerged as a simpler proposition for the property project loan sector than other more traditional lending options.

Many traditional lending overheads cover retail branch networks, real estate and staff, expensive to maintain legacy IT systems, city offices, substantial compliance costs, and more. A marketplace lender faces few of these costs and is able to apply significant efficiencies as a result.

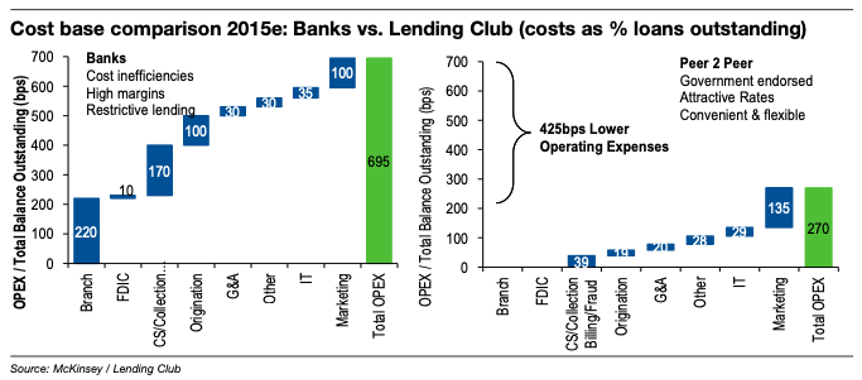

To illustrate this, have a look at the chart below. A McKinsey study into P2P pioneer Lending Club (US) shows that Lending Club expects to be 60 percent more efficient than an “equivalent banking business”. Although this is a US study, the situation is very similar in Australia.

The study says:

- Lending Club expects to be 60 percent more efficient than the equivalent banking business, on costs as percent of loan balances

- P2P has no expensive branches/legacy systems/expensive regulatory capital to service

By avoiding these overheads and offering an investment with slightly higher risk than a bank, marketplace lenders are able offer higher target returns*. In Lending Club’s case, up to six-fold higher returns than the banks in the study.

Australian investors currently have $450 billion in cash saving accounts earning less than 0.8 percent returns per annum . It is, of course, important to point out that traditional lenders like banks are heavily regulated, government backed, and cash savings have a much lower-risk profile than non-bank marketplace lending. However, for risk-aware and informed professional and wholesale investors, marketplace lending alternatives are emerging as an interesting option.

CrowdProperty Australia is a new non-bank, marketplace (peer-to-peer) lender where wholesale investors can invest in property project loans and earn up to 7% target income returns* on first mortgage security.

If you’d like to find out more, please get in touch.

*Target returns, not forecast returns. For wholesale investors only. Terms, conditions and risks apply.