Property developers should consider a range of factors when selecting lenders. In addition to cost of funds, these factors include transparency, timeliness, trustworthiness, market expertise and quality of service.

Small-scale property developers can now choose from a broad range of potential lenders to finance their projects.

In addition to the traditional banks, developers also have the option of accessing funds from non-bank lenders such as marketplace lenders who use online technology to connect them with investors.

Not all lenders are the same however, and they can vary tremendously when it comes to financing costs, levels of expertise, and service quality.

Property developers (‘borrowers’) on the hunt for funding should consider the following factors when choosing a lender that best suits their needs.

Costs and transparency

The fees and interest rates charged by lenders can be highly variable, while many also charge hidden fees that can make a big difference to the final cost of funds for borrowers.

These hidden fees can be expensive, unnecessary, or even punitive in their effects. They can include very high monitoring fees, as well as loan management fees that charge customers for what is basically the job of lenders and brokers in the first place.

These can be hidden as ‘management fees’, ‘admin fees’, ‘line fees’ and in some cases, the borrower is only made aware of the fees once they have already paid potentially many thousands of dollars as a ‘commitment fee’. Up to this point it’s common they will have only seen indicative terms.

A survey conducted by CrowdProperty UK shows that the majority of small-scale property developer borrowers were not aware of their penalty rates. For example, 25% of people surveyed did not know their penalty rate. Of those who did, 32% knew it was greater than 2% per month.

For this reason, transparency around financing costs is essential when assessing the merits of lenders, something CrowdProeprty has taken seriously since its inception in the UK in 2014.

Specialist expertise

Different lenders have varying levels of expertise and specialisation. Some serve as generalists that cater to all comers, while others focus on specific niches where they have unique expertise.

In the case of CrowdProperty, our team consists of property experts who specialise in providing first mortgage financing of high quality residential real estate developments.

We build direct relationships with developers, as well as provide them with ongoing support and personalised guidance during the course of projects and the usage of funds.

Our expertise enables us to do a faster and more effective job when it comes to due diligence on projects, using our proprietary 57-step process that makes extensive use of data point analysis.

Being a specialist property lender, we’re able to offer customer-centric services designed by and for developers with greater ease, speed and certainty than non-specialist providers.

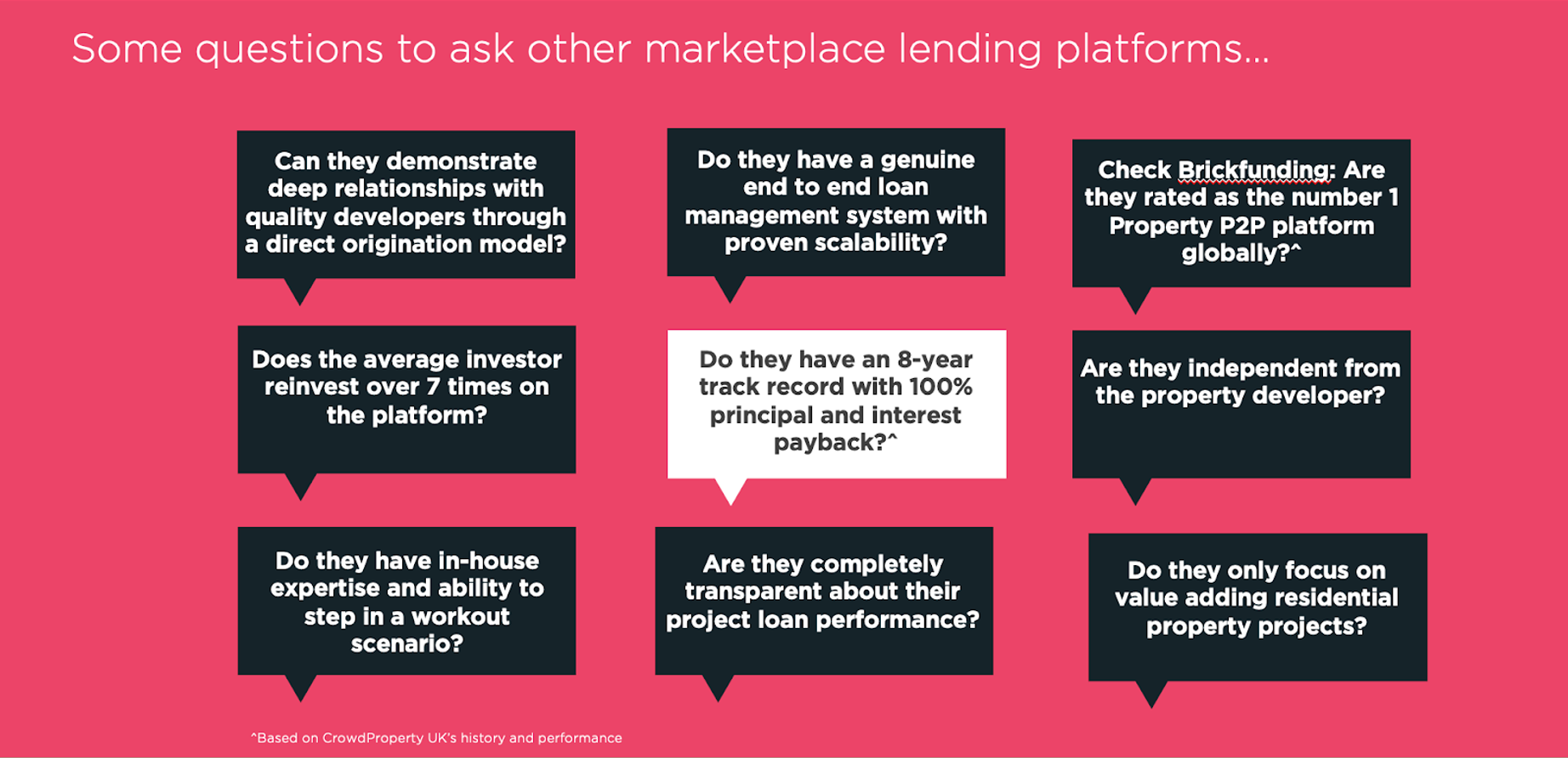

As part of their own due diligence, when considering a lender for your development project there are a number of key questions developers should ask: