How marketplace lending provides speed, ease, and certainty of finance

Marketplace lending matches funds from wholesale clients and professional investors with SME property developers — it’s efficient, simple and fast.

Marketplace, or peer-to-peer lending (P2P) represents potentially the most efficient matching of supply and demand in the small-scale developer lending market.

CrowdProperty efficiently matches borrowers (small-scale property developers) and investors of various types.

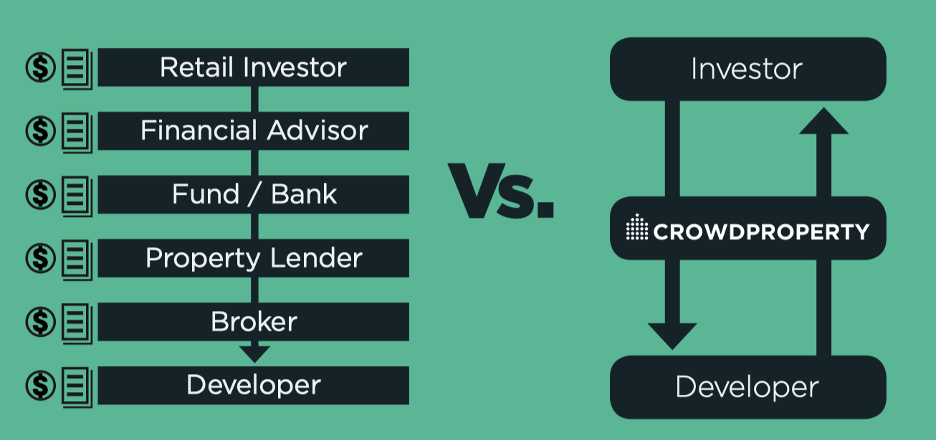

When investing in property through conventional channels, there are many interested parties who each want to be paid fees — financial advisers, fund companies or banks, property lenders, brokers.

All of these layers represent a slow, expensive process.

These parties stand between those lending the capital and the developer, with each provider ‘clipping the ticket’ on the way, reducing financial returns. They each need to cover costs and make profit.

Marketplace lending, like CrowdProperty, helps align the interests of two sides of a supply and demand market — in this case, property developers who need simple, fast, and certain finance, and wholesale investors who want higher target income return* options than are often offered by more traditional channels, and are aware of the risks. The flexibility of a specialist property project loan administrator means decisions are made quickly by property specialists.

Your next steps

Get in touch to find out more about how you can invest with CrowdProperty